CHATBOT FOR WEALTH MANAGEMENT

Wealth management is more than just financial consultation from a professional advisor. It is a discipline that incorporates all parts of a person’s financial life. With advancing technology and automation tools and techniques, wealth management businesses are leveraging the power of conversational bots to address the diverse needs of clients and manage their wealth and investments holistically. Whizard chatbot for wealth management is the ideal tool for organizations to provide a wide range of financial services to increase customer engagement, generate qualified leads, monitor client’s financial data and facilitate other transactions using the most popular messaging app, WhatsApp.

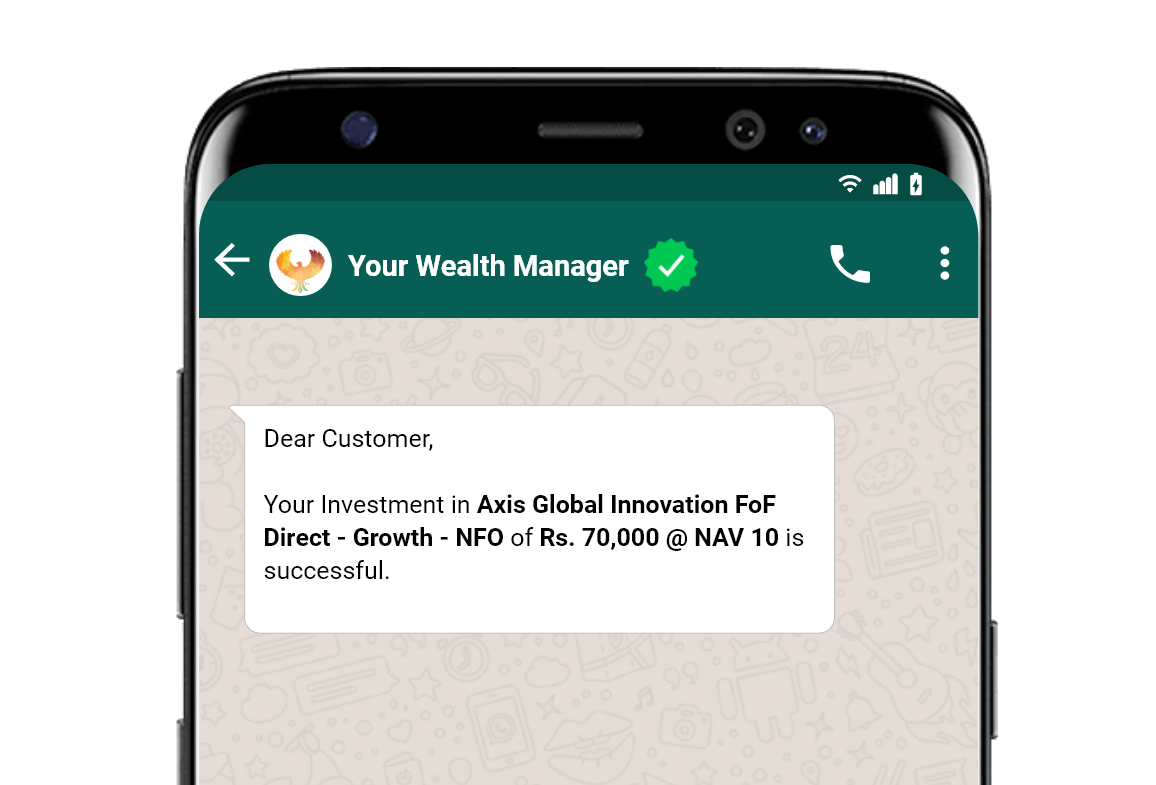

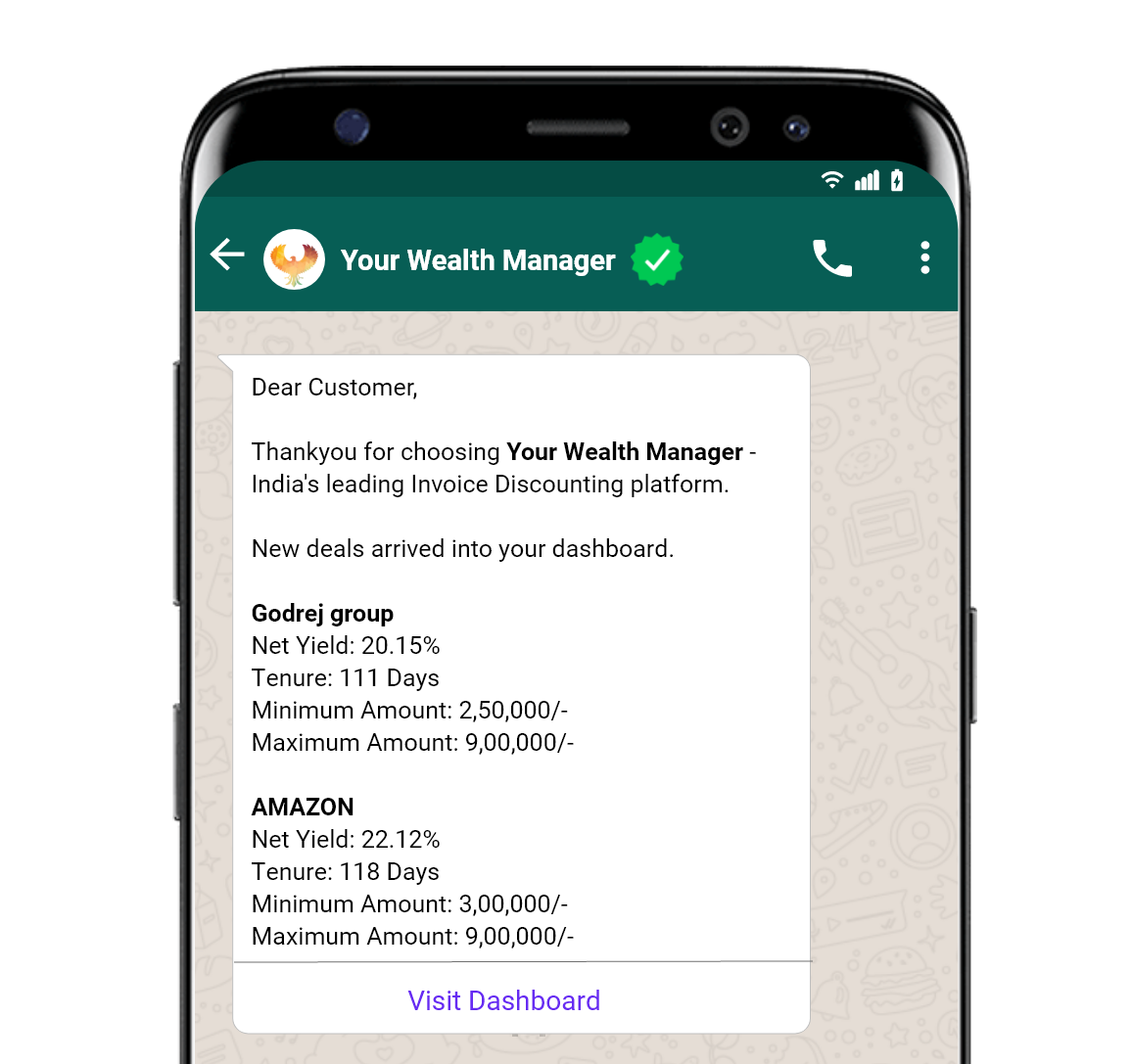

FACILITATE FINANCIAL AND INVESTMENT TRANSACTIONS

Chatbot is an extremely helpful tool to examine a client’s financial transactions and accordingly suggest the best course of action, portfolio choices and investment advice to determine the best way forward. Wealth management chatbots act like quick virtual financial advisors so that businesses can keep a close eye on their customers’ fund flow.

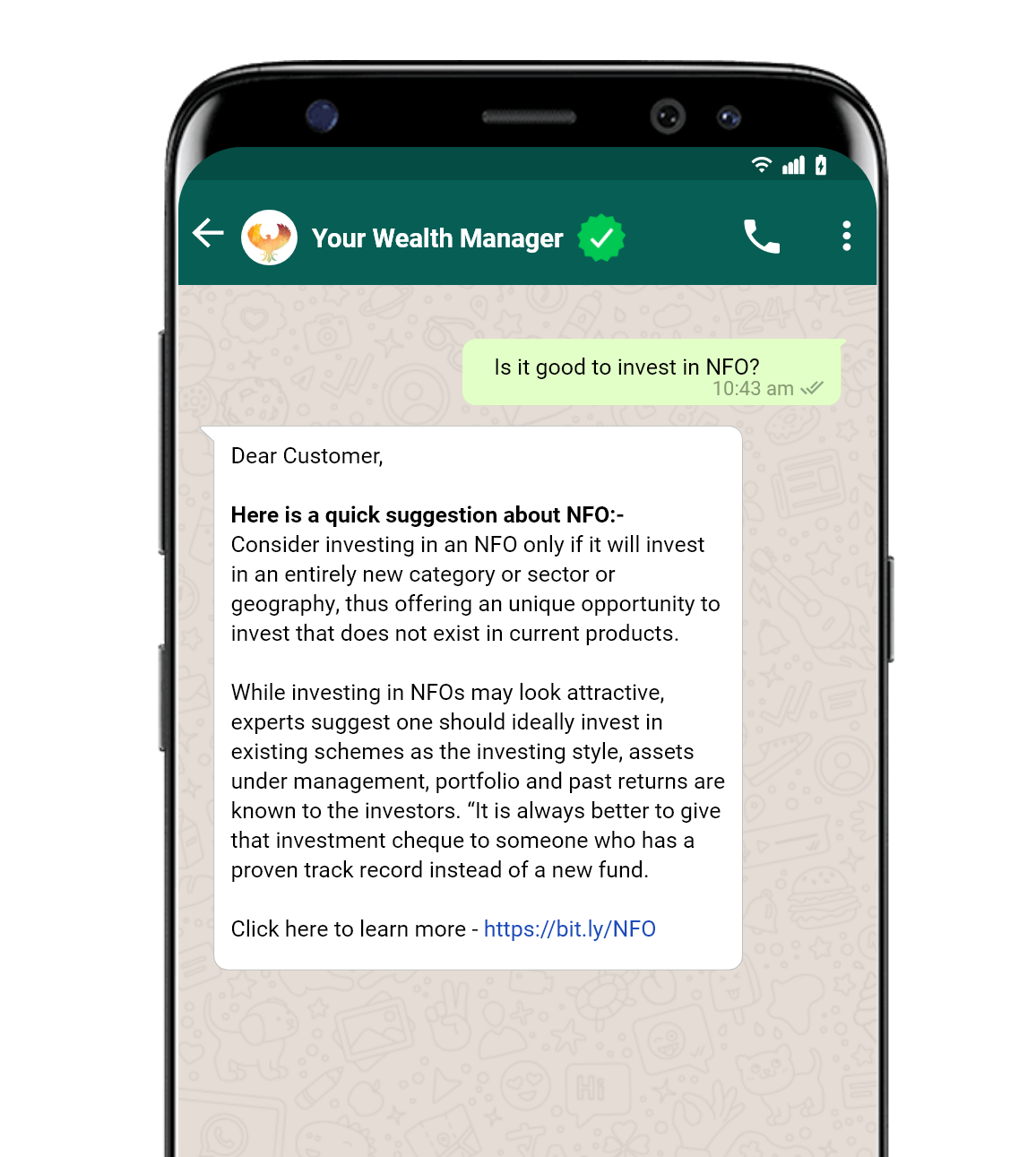

PROVIDE PERSONALIZED RECOMMENDATIONS ON INVESTMENT DECISIONS

By examining and analyzing customer’s current financial situation, risk appetite and financial goals, businesses can conveniently provide personalized recommendations with the help of automated chat replies. Such type of personalization, Whizard WhatsApp chatbot can increase the probability of better return on investment for customers and consequently helps wealth management companies to build a trustworthy connection with their customers.

EDUCATE CUSTOMERS ABOUT VARIOUS INVESTMENT OPTIONS

With efficient customer service capabilities, wealth management chatbots can help customers to gain insights about their current financial condition and accordingly make smart decisions about their investment avenues. Chatbots can enable businesses to educate their clients about newer forms of digital assets and investment scenarios such as cryptocurrency in an easily understandable manner.

PERSONAL WEALTH ASSISTANCE THROUGH DATA ANALYTICS

The unique power of chatbots is that they are AI powered which helps them to analyse, measure and provide data-driven insights to customers in order to improve their financial standing. With the help of Whizard chatbot API, financial organizations can safely communicate with their customers and develop a deeper understanding of their needs and preferences through real-time data analytics and algorithms.

What is wealth management chatbot?

Wealth management chatbots act as a virtual financial advisor for people that helps businesses to provide seamless customer support on all its touchpoints. AI powered financial chatbots enable companies to offer personalized wealth management services that suit the needs and preferences of its diverse target audience. Many financial firms are using these chatbots to perform basic activities such as balance inquiry, product information and more.

How to automate asset management with chatbots?

Automating asset management or any other IT procedure for that matter is an efficient method of saving time and precious man-hours as it helps financial firms in the following ways:

- A chatbot acts as a quick gateway for employees to access important information by helping them locate processes, navigate documentation, resolve queries and find answers in a faster way.

- Ease out the process of connecting with clients by sending regular updates, alerts and set follow up reminders for users.

- Chatbots contribute in HR functions as well by helping employees track asset allocation and asset movement just by asking some questions in an application form on WhatsApp.